What is a Merchant Cash Advance?

A merchant cash advance (MCA) is a form of financing that offers small business owners fast access to short-term working capital.

In its original form, a merchant cash advance was designed for restaurants, retailers, and other businesses who accepted payment by credit card. The cash advance provider would agree to advance money today in exchange for a specified percentage of future credit card receipts. When sales increased, the business would pay back more; when sales decreased, the business would pay back less. For many business owners, this variable repayment structure had great appeal, as it allowed them to conserve cash in slow periods, while making up for it in periods of higher revenues.

One noteworthy aspect of the merchant cash advance is that repayments are not made by the borrower directly. Rather, upon obtaining a cash advance, the business owner is required to instruct its merchant processor (the service provider enabling it to accept credit cards) to route a specified percentage of sales directly to the funder (the firm that provided the advance) on a daily basis. Obtaining repayment directly from the processor reduces the funder’s risk and enables them to provide approvals broadly, even to business owners with weaker credit.

Introducing the Daily Debit Loan…

As the merchant cash advance industry grew, several new lenders recognized the need for a short-term business loan that could accommodate a broader range of industries, underwrite all forms of revenue, and provide borrowers with the predictability of a fixed daily payment. Today this product, known as a daily debit loan, is the primary form of short-term working capital for growing small businesses.

Unlike a merchant cash advance in which the borrower makes a variable payment directly from its merchant processor, a daily debit loan has fixed daily payments that are pulled from the borrower’s bank account. For many businesses, especially those in B2B, the ability to plan for an exact payment amount on a fixed time horizon simplified cash flow management. Moreover, because they are underwritten on all revenues, rather than only credit card sales, these businesses often qualify for larger loan amounts that can be repaid over longer time periods.

Despite the unique aspects of each product noted above, the merchant cash advance and daily debit loan have more similarities than differences. As we look at terms and pricing, the terms will be used interchangeably.

How Expensive is a Merchant Cash Advance?

It depends. As a form of alternative lending (non-bank), merchant cash advances are designed to serve borrowers across the entire credit spectrum. Before we dive into specific terms, let’s explore how these products are priced.

Merchant cash advances and daily debit loans are priced on a factor rate. The factor rate shows the dollar amount the merchant will repay over the term of the loan for every dollar they borrow. For example, a 1.42 factor rate means a business that borrows $10,000 will eventually repay $14,200. Payments are usually made daily – excluding weekends and holidays – which means every month the borrower will make between 20 and 22 payments.

Amount Borrowed x Factor Rate = Amount Repaid

The term of a merchant cash advance – the amount of time over which repayment is scheduled to occur – can vary between as short as 60 days and as long as 18 months. The number of daily payments the borrower will make can be estimated by:

Term (in months) x 21 payments = Total Payments

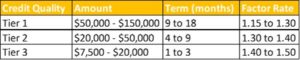

In general, there are three tiers of merchant cash advance:

While there are exceptions within each tier, the general rule-of-thumb is that businesses with better credit will obtain larger loans with longer terms, while those with lesser credit will obtain smaller advances with shorter terms. Often, merchants who start with a short-term, small dollar amount advance and pay as agreed can graduate into successively larger loans with longer terms and lower factor rates.

So…Is a Merchant Cash Advance Right for Me?

One of the main attractions of daily debit loans is that a borrower can be underwritten and funded in as little as 24 hours. However, just because you can get access to fast cash doesn’t mean you should take it. As with any form of borrowing, making sure you have a clear use of funds and established plan for repayment is critical to success. Once you have those in place, a merchant cash advance or daily debit loan is great for:

- Reducing inventory costs by purchasing in bulk

- Bridging cash flow gaps until you receive payment from clients

- Capitalizing on unanticipated growth or cost-saving opportunities

- Maintaining cash buffer to manage working capital swings

To learn more about whether a merchant cash advance or daily debit loan is right for you, please contact us directly at 855-610-5626 or sales@dealstruck.com.